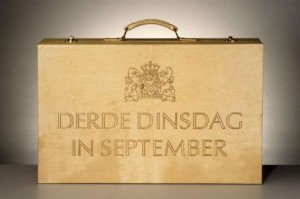

On 15 September 2020 the Dutch government published its 2021 tax plans. They are as expected without any breaking news. Together with earlier announced proposals, the following key tax items are now on the 2021 corporate tax agenda:

- Introduction of a COVID-19 tax reserve.

- Introduction of a new conditional withholding tax on interest & royalty payments to affiliated entities in selected low-tax and non-cooperative countries (see country list below).

- Certain investment tax benefits.

- Enhanced substance rules for Dutch financing & licensing companies, including a ≥ €100k payroll requirement, to avoid automatic-exchange-of-information.

See details on these and other relevant legislative proposals below.

Next to the 2021 legislative proposals, certain announcements were made for following years:

- Per 2022, an extension of loss carry forward rules, with certain restrictions.

- Per 2022, transfer pricing adjustments targeting informal capital structures.

- Per 2022, Dutch holding companies to be added to the scope of the enhanced substance rules for Dutch financing & licensing companies.

- Per 2022, amendments to the refund mechanism for dividend withholding tax.

- Per 2024, dividend payments to be added to the scope of the new conditional withholding tax on interest & royalty payments to selected low-tax and non-cooperative countries.

- Further work will be done on the revision of the Dutch tax qualification rules of partnership entities, and the introduction of equity tax deductions.

See details on these announcements below.

Details on legislative proposals

COVID-19 Tax Reserve

As part of the Decree COVID-19 measures the Dutch government introduced the COVID-19 tax reserve. Tax payers who are faced with tax losses in 2020, can book a tax reserve for the amount of the expected 2020 tax losses in their 2019 corporate income tax return up to the amount of the 2019 taxable profits. This measure is now part of the proposed 2021 tax plan.

Introduction Withholding Tax Interest & Royalty Payments

To counter payments to off-shore structures, a new withholding tax will be introduced per 2021 on interest & royalty payments to affiliated entities which are resident in selected low-tax and non-cooperative countries (see country list below). The rate will be equal to the Dutch corporate income tax rate, see next bullet.

Decrease Corporate Income Tax Rate

The previously announced decrease of the corporate income tax rate of 25% to 21.7% has unfortunately been withdrawn. The lower bracket will decrease from 16.5% to 15% as per the previous announcement. The threshold for the lower bracket will be EUR 245,000 in 2021 and EUR 395,000 in 2022.

Investment Tax Benefits

It is proposed to provide tax payers with an incentive to invest in the Netherlands. Specific rules will be proposed to allow tax payers to deduct a percentage of investment amounts from wage taxes to be paid in 2021.

Enhanced substance Rules Dutch Financing & Licensing Companies

To discourage the use of letterbox companies, Dutch financing & licensing companies need to adhere to enhanced Dutch substance rules to avoid automatic exchange of information to source countries. The enhanced substance rules come down to office space and a minimum €100k annual employee cost for relevant activities.

Increase Effective Tax Rate Innovation Box Regime

As already announced earlier, the effective tax rate in the innovation box regime will be increased from 7% to 9%. The tax credit for withholding tax on royalty’s will be adjusted similarly.

Technical Adjustment Dutch Anti-Base Erosion Rules

The Dutch anti-base erosion rules could result in a tax exemption for the amount of negative interest or FX profits. The proposed adjustment does not allow for this positive result to be exempt from the taxable basis.

Details on announcements

Loss Compensation Rules

The loss carry-forward is proposed to no longer be limited in time. The loss carry-forward and carry-back will however be limited up to either EUR 1,000,000 or 50% of the profits, whichever is higher.

Transfer Pricing Mismatches

To further address mismatches which result in tax advantages for especially multinationals, the Dutch government will publish a legislative proposal to eliminate transfer pricing mismatches in spring 2021. International intercompany transactions should be done at arm’s length. Where transactions have not be done at arm’s length, transfer pricing corrections are typically made. If the other country does not tax the transfer pricing correction into account and the Netherlands does, this results in a mismatch. In case the transfer pricing adjustment results in a lower profit in the Netherlands, but the other country does not increase the profit – or not in full – it is proposed that the Netherlands will no longer allow for the tax payer to take into account the lower profit. For example, where a Dutch company acquires an asset from a foreign subsidiary and books this asset against market value, but the selling subsidiary only takes into account the purchase price in their profit, the Netherlands will no longer allow for this ‘step up’ to be taken into account.

New Rules Dutch Holding Companies

In order to discourage the use of letterbox companies, Dutch holding companies will – similar to Dutch financing and licensing companies – be required to avail of enhanced substance in the Netherlands, at the penalty of automatic exchange of information with the relevant source country(ies).

Refund Dividend Withholding Tax

Currently Dutch tax payers can request for a refund of dividend withholding tax paid in the case they are in a loss position. Foreign tax payers, who are not subject to Dutch corporate income tax, cannot request for such a refund. To comply with EU law, the Dutch government intends to no longer allow for a refund of dividend withholding tax in case the Dutch tax payer is in a loss position as per 2022. In such case the credit of the dividend withholding tax will be carried forward to a following tax year. An upside is that in the meantime a Decree will be published which temporarily allows foreign tax payers to request for a refund of the Dutch withholding tax paid on dividends.

Conditional Withholding Tax Dividends

In spring 2021 the Dutch government will publish its legislative proposal for a conditional withholding tax on dividends, applicable to dividends paid to related entities in low-tax or EU blacklisted jurisdictions, or in cases of abuse. It is expected that this will enter into force as per 2024.

Equity Tax deductions

In order to come to a more balanced approach to the Dutch tax treatment of equity versus debt financing, the government has announced to review the possibility to introduce a tax deduction on equity financing.

Amendments Dutch Partnership Qualification Tax Rules

Triggered by the hybrid mismatch overkill resulting from the European ATAD2 directive, the Dutch government is reviewing the Dutch tax qualification rules for Dutch and foreign partnership entities.

Annex: list of low-tax and non-cooperative jurisdictions (as applicable in 2020)

American Samoa, Barbados, Guam, Samoa, Vanuatu, American Virgin Islands, Bermuda, Guernsey, Turkmenistan, Anguilla, British Virgin Islands, Isle of Man, Turks and Caicos Islands, Bahamas, Cayman Islands, Jersey, Trinidad and Tobago, Bahrain, Fiji, Oman and United Arab Emirates.

More information?

For more information, please contact Evert-Jan Spoelder or Gerriët Nagelhout.