Recent heeft rechtbank Den Haag bepaald dat als een werkgever de 30%-regeling niet in de salarisadministratie heeft toegepast, de werknemer de onbelaste 30%-vergoeding niet alsnog kan claimen door zijn loon in de aangifte inkomstenbelasting te corrigeren. De 30%-vergoeding kan alleen onbelast blijven als de werkgever deze onder de werkkostenregeling als eindheffingsloon heeft “aangewezen”. Nu de werkgever de 30%-regeling niet heeft toegepast in de salarisadministratie, betekent dit volgens de rechtbank dat de werkgever de vergoeding niet heeft aangewezen en de 30%-regeling niet alsnog in de aangifte inkomstenbelasting kan worden toepast. Het is de vraag of de uitkomst anders zou zijn geweest als werkgever de “aanwijzing” op een andere manier in zijn administratie had vastgelegd.

Categorie: Nieuws

Netherlands: new entity classification rules per 2022

On March 29th 2021, the Dutch Ministry of Finance announced a long-awaited overhaul of Dutch entity classification tax rules per 2022 – basically aligning the rules with global standards. The rules include the withdrawal of the ‘unanimous consent requirement’ for tax-transparency classification of Dutch CV and foreign limited partnerships, classifying these entities as tax-transparent by default. It also leads to termination of the Dutch non-transparent CV. Dutch FGR’s in principle also become tax transparent, with an option of electing for a non-transparent tax status in certain situations.

The announcement responds to the escalation of hybrid entity mismatches under ATAD2: as the current Dutch entity classification rules deviate from international standards, hybrid entity mismatches occur as the Netherlands and other jurisdictions do not align on entity classification.

Practical impact

Impact of the announced overhaul is that as of 1/1/2022, any Dutch CV and comparable foreign limited partnership entity will classify as tax-transparent by default, without the need for specific unanimous consent language anymore. Certain transitional rules will apply for existing Dutch non- transparent CV’s as they become tax-transparent for Dutch tax purposes.

For other foreign entities that are not comparable to a Dutch entity (such as UK LLP, Irish ULC, German KGaA), the Dutch classification will align with the foreign entity classification.

Due to the automatic entity classification switch per 1/1/2022, the tax position of existing CV/FGR and comparable foreign entities and its investors will have to be assessed. It could have a major impact, impacting inter alia the application of the participation exemption regime, (ATAD2) interest deduction rules, loss compensation and foreign tax liability.

What’s next

The announcement came in the form of a public consultation, open for responses until 26 April 2021. Final draft legislation is expected in September 2021, allowing a go-live per 1/1/2022.

For more information on the above, please contact Evert-Jan Spoelder (evert- jan.spoelder@taxand.nl )

Verkiezingen: vastgoed en fiscaliteit

Het is bijna zover: de verkiezingen. Een goed moment om de fiscale standpunten op het gebied van vastgoed op een rij te zetten.

In deze bijdrage van Susan Raaijmakers en Richard Meerstra wordt ingegaan op zowel de direct (overdrachtsbelasting, box 3) als indirect (schenk- en erfbelasting) aan vastgoed gerelateerde standpunten. Juist vastgoedportefeuilles wordt immers vaak via schenken of erven overgedragen.

Voor meer informatie kunt u contact opnemen met Susan Raaijmakers of Richard Meerstra.

New Dutch legislative proposal on transfer pricing mismatches

The 4th of March, a new Dutch legislative proposal has been published for public consultation in order to prevent tax avoidance due to mismatches that relate to transfer pricing. At the same time two other proposals have been filed with respect to Atad2 application and qualification of foreign entities, which will not be covered in this news flash.

The legislative proposal includes a new Corporate Income Tax law article, which targets mismatches that exist because of commercial to tax differences that lead to a lower taxable income without a pick-up in the other jurisdiction. The main reason being that a different system is being applied in the other jurisdiction.

In the Netherlands, the arm’s length principle implies that associated enterprises within a group have to comply with the arm’s length principle for corporate income tax purposes. Commercially, transactions are not always aligned with the arm’s length principle which may lead to commercial to tax differences as a consequence. If other countries involved apply the arm’s length principle differently or not at all, the risk of mismatches arises. Mismatches may result in double non taxation.

Examples are interest rates, a “step-up” for assets or additional income reported on transactions, which are adjustments to align with the arm’s length principle. This may lead to either an informal capital contribution or a deemed dividend from the perspective of the Dutch company. If such adjustments lead to a lower taxable income in the Netherlands, but not to an equally higher taxable income, pick-up, in the other country(ies) involved, the new article will apply. According to the newly proposed art. 8ba VPB, the deductibility of for example interest rate adjustments will partly be rejected for negative tax to commercial differences, if the taxpayer is not able to proof that a corresponding upward adjustment is made at the end of the foreign entity. Also downward income adjustments or a “step up” for assets with corresponding depreciation, will only lead to a lower taxable income, if the transactions are declared accordingly in the other jurisdiction. It may also impact back-to-back financials transactions.

It is intended that this new article will come into effect on 1 January 2022.

For more information please contact Jimmie van der Zwaan or Thomas Dijksman

Webinar Grensoverschrijdend Detacheren – 24 november 2020

Op dinsdag 24 november 2020 geven Lexence en Taxand van 10:00 uur tot 11.00 uur een live webinar (via Zoom) over grensoverschrijdend detacheren en de belangrijkste wijzigingen en aandachtspunten.

Het programma van het webinar is als volgt:

“Posted Workers Directive” en de arbeidsrechtelijke gevolgen

• Achtergrond

• Inhoud van de regeling

• Wat betekent het voor u?

• Sancties

• Praktische tips

Fiscaliteit en sociale zekerheid

• Fiscaliteit en sociale zekerheid bij grensoverschrijdend detacheren

• Inhoudingsplicht en verleggingsregeling

• Inlenersaansprakelijkheid

Uiteraard is er tijdens het webinar ruimte voor het stellen van vragen.

Aanmelden?

U kunt zich hier aanmelden voor het webinar. Deelname is gratis.

Graag tot 24 november!

Webinar Dutch-India Investment Corridor 5 November 2020

Join us for our first Netherlands-India Investment Seminar on 5 November at 13:00 CEST | 16.30 IST.

The webinar will discuss potential structures for India and Netherlands outbound/inbound investments and nuances relating thereto, focused on creating opportunities arising from the Netherlands-India tax treaty.

Speakers:

Taxand Netherlands

Evert-Jan Spoelder & Berend van Holthuijsen

Taxand India

Nishant Shah & Rahul Charkha

Want to register?

For more info and to register, please send an email to maaike.vanderaa@taxand.nl

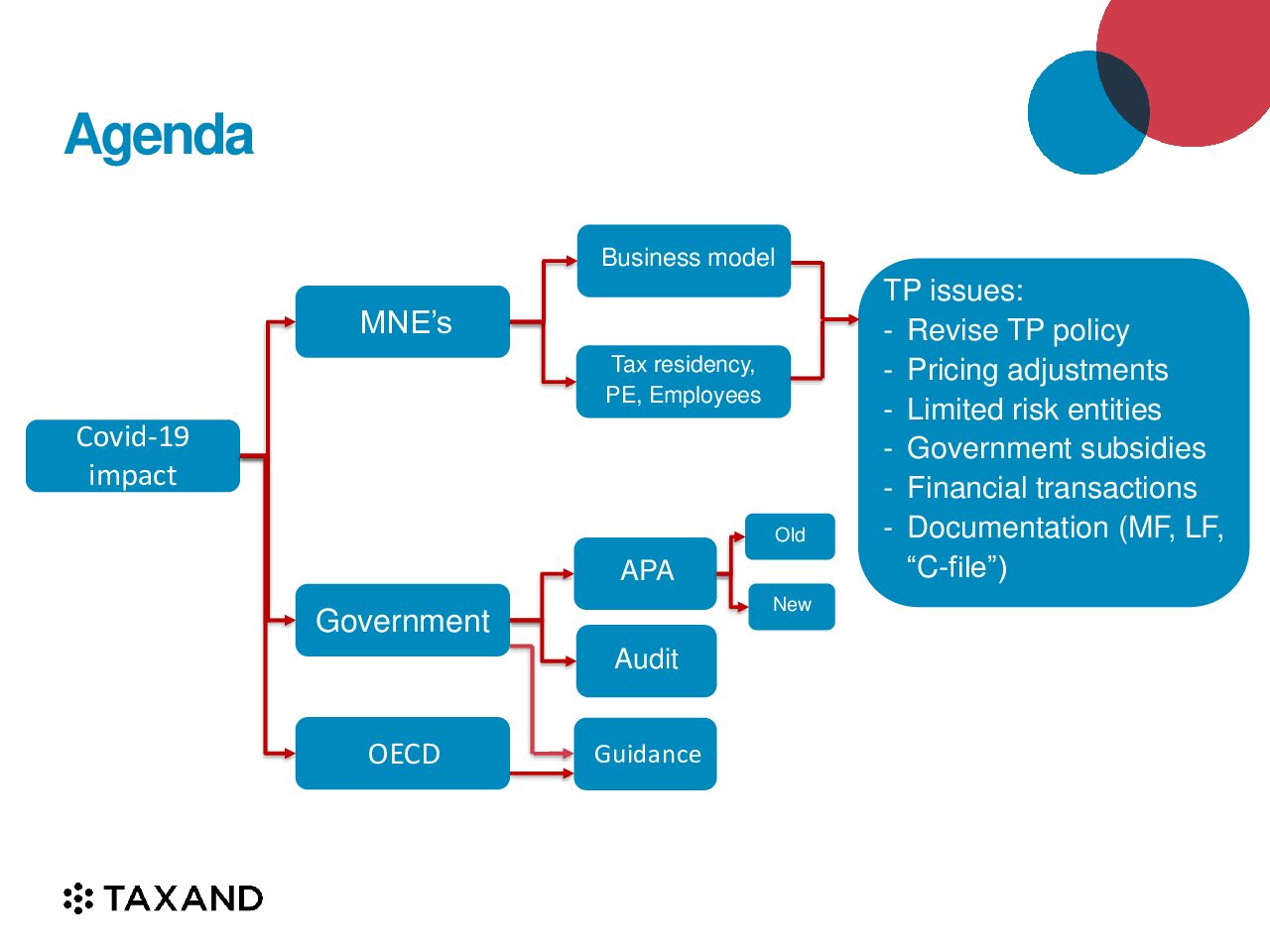

Watch recorded webinar – Transfer Pricing in Covid-19 Times

Taxand Netherlands has organized a webinar about the impact of COVID-19 on intercompany transactions (transfer pricing). The webinar will help you to make the right amendments in your transfer pricing system, transfer pricing documentation and intra group agreements.

Watch the webinar?

Please find below the recorded webinar. For the slides, click here. If you have any questions, please contact Jimmie van der Zwaan or Thomas Dijksman.

Webinar – Transfer Pricing in Covid-19 Times – 1 October 2020

Tax alert Prinsjesdag 2020 voor vermogende particulieren en (familie)ondernemingen

Op dinsdag 15 september 2020 heeft kabinet Rutte-III het Belastingplan 2021 gepresenteerd. In bijgevoegde Tax Alert hebben wij een overzicht gemaakt van onderwerpen uit het Belastingplan die van belang kunnen zijn voor vermogende particulieren, dga’s en (familie)ondernemingen.

Wij behandelen in onze Tax Alert achtereenvolgens de volgende voorgestelde maatregelen:

- Maatregelen voor vermogende particulieren en beleggers

- Maatregelen voor directeur-grootaandeelhouders (dga’s)

- Maatregelen voor familiebedrijven / ondernemers

- Maatregelen voor stichtingen en verenigingen (inclusief ANBI’s)

- Maatregelen bezwaar/beroep en maatregelen voor invordering van belastingschulden

- Overige relevante maatregelen

De Tax Alert kunt u hier bekijken!

Wilt u weten wat de bovenstaande maatregelingen voor uw fiscale positie betekenen? Of wilt u weten wat de mogelijkheden zijn om bepaalde negatieve effecten te verminderen? Neem dan vrijblijvend contact op met Majid Ettafahi, fiscaal partner vermogende particulieren en familiebedrijven, of met Niels Meloen.

Budget day 2021 – Wage tax & social security

DUTCH BUDGET UPDATE 2021 – Wage tax & social security

On Budget Day, September 15, 2020, the Dutch government presented the 2021 Tax Plan. We have listed the most important changes proposed for Dutch wage tax & social security (Items 1-4). In addition, we have included some relevant items that have already been implemented or will be implemented in the near future (Items 5-8).

1. Work Related Cost Scheme

- 2020: the temporary increase of the tax-free budget will be given a legal basis. The tax-free budget will be increased to 3% on the first EUR 400,000 of the employer’s fiscal wages, 1.2% applies to the remainder part.

- 2021: the tax free budget will be 1.7% on the first EUR 400,000 of the employer’s fiscal wages and 1.18% on the remainder part.

2. Extension of the exemption for training costs

- The tax exemption for providing or reimbursing employees for study or education will be extended to former employees. It is expected that this will lead to an increased focus of employers on study and education with regard to termination packages.

3. Taxable benefit for electric company cars

- Per 2021, the taxable benefit of electric company cars will be increased form 8% to 12% of the catalogue value of the car up to a value of EUR 40,000. The taxable benefit on the excess value will be 22%.

- For a hydrogen car and a solar cell car, the taxable benefit can be applied to the entire value of the car.

4. Changes in the transitional law of the Life cycle savings scheme (“Levensloopregeling”)

- The entitlement to the funds in the scheme can be paid out up to and including 31 October 2021. Per 1 November 2021, wage tax is due on the not paid out entitlements.

- The organization that has implemented the scheme will act as the Dutch wage tax withholding agent.

5. Extension of taxation on stock options of start-ups

- The announced adjustment of the taxable moment of stock options in start-ups and scale-ups is extended to 1 January 2022.

6. Replacement and update on the DBA Act

- New regulations are still being worked on. The proposed web module will be further developed.

- The exact new regulations are not expected before 2021.

- The DBA Act is and will remain in force, but will not be fully enforced until 1 January 2021.

7. Posted Worker notification obligation

- As of 1 March 2020, employers abroad and self-employed persons from countries within the European Economic Area (EEA) and Switzerland are obliged to notify temporary postings in the Netherlands.

- Per 1 September 2020 non-compliance leads to administrative penalties. For more information, please see the following link: Taxand reporting requirement posted worker information

More information?

Should you require any further information on the above or have any questions, please feel free to contact Sander Michaël or Chris van Wijngaarden.

Dutch Budget Day Update 2021

On 15 September 2020 the Dutch government published its 2021 tax plans. They are as expected without any breaking news. Together with earlier announced proposals, the following key tax items are now on the 2021 corporate tax agenda:

- Introduction of a COVID-19 tax reserve.

- Introduction of a new conditional withholding tax on interest & royalty payments to affiliated entities in selected low-tax and non-cooperative countries (see country list below).

- Certain investment tax benefits.

- Enhanced substance rules for Dutch financing & licensing companies, including a ≥ €100k payroll requirement, to avoid automatic-exchange-of-information.

See details on these and other relevant legislative proposals below.

Next to the 2021 legislative proposals, certain announcements were made for following years:

- Per 2022, an extension of loss carry forward rules, with certain restrictions.

- Per 2022, transfer pricing adjustments targeting informal capital structures.

- Per 2022, Dutch holding companies to be added to the scope of the enhanced substance rules for Dutch financing & licensing companies.

- Per 2022, amendments to the refund mechanism for dividend withholding tax.

- Per 2024, dividend payments to be added to the scope of the new conditional withholding tax on interest & royalty payments to selected low-tax and non-cooperative countries.

- Further work will be done on the revision of the Dutch tax qualification rules of partnership entities, and the introduction of equity tax deductions.

See details on these announcements below.

Details on legislative proposals

COVID-19 Tax Reserve

As part of the Decree COVID-19 measures the Dutch government introduced the COVID-19 tax reserve. Tax payers who are faced with tax losses in 2020, can book a tax reserve for the amount of the expected 2020 tax losses in their 2019 corporate income tax return up to the amount of the 2019 taxable profits. This measure is now part of the proposed 2021 tax plan.

Introduction Withholding Tax Interest & Royalty Payments

To counter payments to off-shore structures, a new withholding tax will be introduced per 2021 on interest & royalty payments to affiliated entities which are resident in selected low-tax and non-cooperative countries (see country list below). The rate will be equal to the Dutch corporate income tax rate, see next bullet.

Decrease Corporate Income Tax Rate

The previously announced decrease of the corporate income tax rate of 25% to 21.7% has unfortunately been withdrawn. The lower bracket will decrease from 16.5% to 15% as per the previous announcement. The threshold for the lower bracket will be EUR 245,000 in 2021 and EUR 395,000 in 2022.

Investment Tax Benefits

It is proposed to provide tax payers with an incentive to invest in the Netherlands. Specific rules will be proposed to allow tax payers to deduct a percentage of investment amounts from wage taxes to be paid in 2021.

Enhanced substance Rules Dutch Financing & Licensing Companies

To discourage the use of letterbox companies, Dutch financing & licensing companies need to adhere to enhanced Dutch substance rules to avoid automatic exchange of information to source countries. The enhanced substance rules come down to office space and a minimum €100k annual employee cost for relevant activities.

Increase Effective Tax Rate Innovation Box Regime

As already announced earlier, the effective tax rate in the innovation box regime will be increased from 7% to 9%. The tax credit for withholding tax on royalty’s will be adjusted similarly.

Technical Adjustment Dutch Anti-Base Erosion Rules

The Dutch anti-base erosion rules could result in a tax exemption for the amount of negative interest or FX profits. The proposed adjustment does not allow for this positive result to be exempt from the taxable basis.

Details on announcements

Loss Compensation Rules

The loss carry-forward is proposed to no longer be limited in time. The loss carry-forward and carry-back will however be limited up to either EUR 1,000,000 or 50% of the profits, whichever is higher.

Transfer Pricing Mismatches

To further address mismatches which result in tax advantages for especially multinationals, the Dutch government will publish a legislative proposal to eliminate transfer pricing mismatches in spring 2021. International intercompany transactions should be done at arm’s length. Where transactions have not be done at arm’s length, transfer pricing corrections are typically made. If the other country does not tax the transfer pricing correction into account and the Netherlands does, this results in a mismatch. In case the transfer pricing adjustment results in a lower profit in the Netherlands, but the other country does not increase the profit – or not in full – it is proposed that the Netherlands will no longer allow for the tax payer to take into account the lower profit. For example, where a Dutch company acquires an asset from a foreign subsidiary and books this asset against market value, but the selling subsidiary only takes into account the purchase price in their profit, the Netherlands will no longer allow for this ‘step up’ to be taken into account.

New Rules Dutch Holding Companies

In order to discourage the use of letterbox companies, Dutch holding companies will – similar to Dutch financing and licensing companies – be required to avail of enhanced substance in the Netherlands, at the penalty of automatic exchange of information with the relevant source country(ies).

Refund Dividend Withholding Tax

Currently Dutch tax payers can request for a refund of dividend withholding tax paid in the case they are in a loss position. Foreign tax payers, who are not subject to Dutch corporate income tax, cannot request for such a refund. To comply with EU law, the Dutch government intends to no longer allow for a refund of dividend withholding tax in case the Dutch tax payer is in a loss position as per 2022. In such case the credit of the dividend withholding tax will be carried forward to a following tax year. An upside is that in the meantime a Decree will be published which temporarily allows foreign tax payers to request for a refund of the Dutch withholding tax paid on dividends.

Conditional Withholding Tax Dividends

In spring 2021 the Dutch government will publish its legislative proposal for a conditional withholding tax on dividends, applicable to dividends paid to related entities in low-tax or EU blacklisted jurisdictions, or in cases of abuse. It is expected that this will enter into force as per 2024.

Equity Tax deductions

In order to come to a more balanced approach to the Dutch tax treatment of equity versus debt financing, the government has announced to review the possibility to introduce a tax deduction on equity financing.

Amendments Dutch Partnership Qualification Tax Rules

Triggered by the hybrid mismatch overkill resulting from the European ATAD2 directive, the Dutch government is reviewing the Dutch tax qualification rules for Dutch and foreign partnership entities.

Annex: list of low-tax and non-cooperative jurisdictions (as applicable in 2020)

American Samoa, Barbados, Guam, Samoa, Vanuatu, American Virgin Islands, Bermuda, Guernsey, Turkmenistan, Anguilla, British Virgin Islands, Isle of Man, Turks and Caicos Islands, Bahamas, Cayman Islands, Jersey, Trinidad and Tobago, Bahrain, Fiji, Oman and United Arab Emirates.

More information?

For more information, please contact Evert-Jan Spoelder or Gerriët Nagelhout.

Taxand Netherlands contributes to Lexology Transfer Pricing Guide

Covering the latest developments in transfer pricing law across the globe, the “Transfer Pricing 2021” publication by Lexology contains updates on topics including: transfer pricing methods, OECD Transfer Pricing Guidelines, permissible cost-sharing arrangements, transfer pricing adjustment rules, “safe harbour” methods, required disclosures and documentation, agencies responsible for enforcement, income tax treaty networks, relief (and its limitations) from double taxation, advance pricing agreements, and any potential tax exemptions or rate reductions available via government bodies.

To read the Dutch contribution of Jimmie van der Zwaan and Thomas Dijksman of Taxand Netherlands: click here.

More information?

If you have any questions, with regard to this article, please contact Jimmie van der Zwaan or Thomas Dijksman.