DUTCH BUDGET UPDATE 2021 – Wage tax & social security

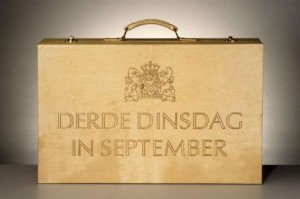

On Budget Day, September 15, 2020, the Dutch government presented the 2021 Tax Plan. We have listed the most important changes proposed for Dutch wage tax & social security (Items 1-4). In addition, we have included some relevant items that have already been implemented or will be implemented in the near future (Items 5-8).

1. Work Related Cost Scheme

- 2020: the temporary increase of the tax-free budget will be given a legal basis. The tax-free budget will be increased to 3% on the first EUR 400,000 of the employer’s fiscal wages, 1.2% applies to the remainder part.

- 2021: the tax free budget will be 1.7% on the first EUR 400,000 of the employer’s fiscal wages and 1.18% on the remainder part.

2. Extension of the exemption for training costs

- The tax exemption for providing or reimbursing employees for study or education will be extended to former employees. It is expected that this will lead to an increased focus of employers on study and education with regard to termination packages.

3. Taxable benefit for electric company cars

- Per 2021, the taxable benefit of electric company cars will be increased form 8% to 12% of the catalogue value of the car up to a value of EUR 40,000. The taxable benefit on the excess value will be 22%.

- For a hydrogen car and a solar cell car, the taxable benefit can be applied to the entire value of the car.

4. Changes in the transitional law of the Life cycle savings scheme (“Levensloopregeling”)

- The entitlement to the funds in the scheme can be paid out up to and including 31 October 2021. Per 1 November 2021, wage tax is due on the not paid out entitlements.

- The organization that has implemented the scheme will act as the Dutch wage tax withholding agent.

5. Extension of taxation on stock options of start-ups

- The announced adjustment of the taxable moment of stock options in start-ups and scale-ups is extended to 1 January 2022.

6. Replacement and update on the DBA Act

- New regulations are still being worked on. The proposed web module will be further developed.

- The exact new regulations are not expected before 2021.

- The DBA Act is and will remain in force, but will not be fully enforced until 1 January 2021.

7. Posted Worker notification obligation

- As of 1 March 2020, employers abroad and self-employed persons from countries within the European Economic Area (EEA) and Switzerland are obliged to notify temporary postings in the Netherlands.

- Per 1 September 2020 non-compliance leads to administrative penalties. For more information, please see the following link: Taxand reporting requirement posted worker information

More information?

Should you require any further information on the above or have any questions, please feel free to contact Sander Michaël or Chris van Wijngaarden.